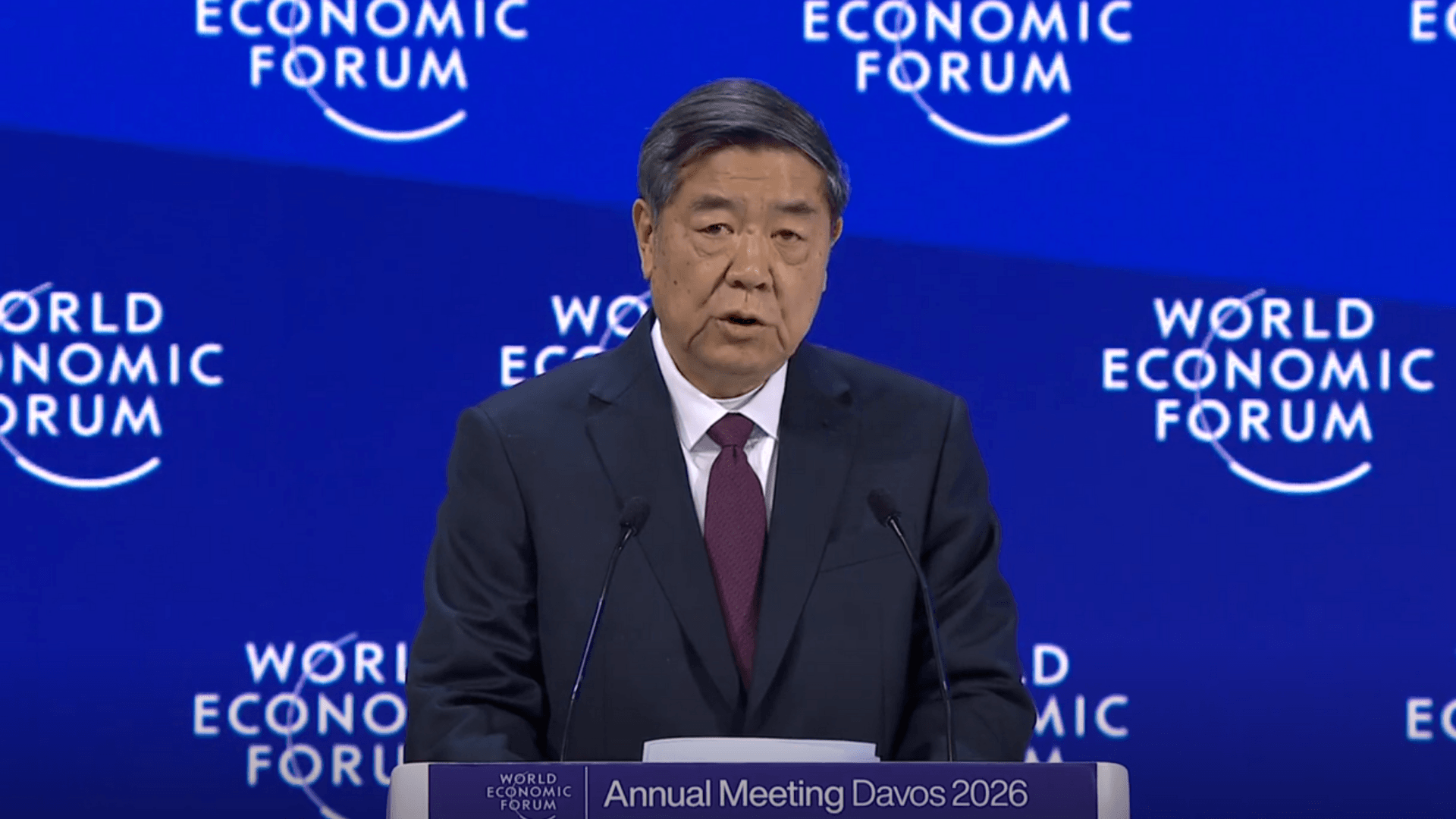

In our first newsletter of the month, we move from Davos to the Munich Security Conference, taking place from 13 to 15 February, right after a new plenary session of the European Parliament. If Davos is where we saw that the old rules fading, Munich is where we will see the new, harsher reality of transactional geopolitics put under its first stress test.

The Greenland Question

A recurring theme will again be the tension over Greenland. As President Trump’s administration continues to frame the territory as a “security necessity” for the Western hemisphere, Munich will serve as another stage for a diplomatic showdown between the US and Denmark. For European leaders, this might be a test of Article 5 itself and the meaning of a decades-long alliance.

The tone of the US delegation, which will likely be led by Vice President JD Vance or Secretary of State Marco Rubio will be a thing to watch out for. They are likely to reiterate a Trump-era variation of the Monroe Doctrine, while European leaders will attempt to present a Europe-dominant security presence in the Arctic. It will be interesting to find out whether the US view NATO as a partnership of equals or treats it more like a real-estate portfolio.

Ukraine and Negotiations

Ukraine will almost certainly remain at the conference’s strategic centre. Following the informal indication that a €90 billion loan from the EU to Ukraine has not yet been reached, the focus in Munich will possibly shift toward the framework set in Abu Dhabi last week. With nearly 50 heads of state and government in attendance, including Chancellor Merz, the discussions will likely centre on what strategic autonomy looks like under real-world conditions.

The sidebar meetings between the Ukrainian delegation and US Senators are something that will also merit close attention. The objective is to see if a consensus can be reached on a peace deal that doesn’t look like a surrender to the aggressor. As Mark Rutte recently noted, Europe must have its own plan for Ukraine if it wants a meaningful seat at the table.

Artificial Superintelligence

Beyond the hardcore diplomacy, MSC will launch the Tech Strategy Initiative on Artificial Superintelligence. Against the backdrop of the EU’s forthcoming Cybersecurity Act proposal, in addition to data protection concerns, the spotlight is at the reduction of critical dependencies on dominant global powers and a limited number of large-scale, third-country technology providers.

This represents the first real attempt to create a shared democratic standard for AI in defence. The goal will be the preservation of technological sovereignty and making sure that mid-sized powers retain control over their own digital and military infrastructure in an era of accelerating algorithmic warfare.

Reading the Room

The focus should not be just the main stage speeches. The real movement in Munich often happens in the side rooms and the Startup Hub. This year, the inclusion of the AfD in the official invitations, reportedly encouraged by the US administration, signals a notable shift. How traditional European powers interact with newer political forces may reveal more about the resilience of the European project over the next four years than any plenary statement.

The Plenary: What to Watch Out For

EU-Mercosur

The discussion on the bilateral safeguard clause for agricultural products represents an attempt to reconcile trade liberalisation with domestic food security concerns. As the EU-Mercosur Interim Trade Agreement moves toward ratification, this specific provision could serve as a safety net for politically sensitive sectors.

The debate will likely focus on triggering mechanisms. The Commission proposed investigations based on a 10% annual import increase, while many MEPs are pushing for a stricter 5% threshold over a three-year average. The underlying aim is to build a mechanism capable of rapidly re-imposing tariffs to prevent market destabilisation, serving as a protective buffer for farmers.

The 2040 Climate Roadmap

The primary focus will likely be the legally binding 90% net emissions-reduction target for 2040. The key issue is how the EU balances domestic emissions cuts with carbon removals. The plenary is expected to emphasise the role of industrial carbon capture and natural sinks, signaling to investors that the transitional path ahead is now anchored in concrete milestones that leave little scope for backsliding.

The Measuring Instruments Directive Amendment

The amendment to the Measuring Instruments Directive is a technical but consequential change for the green economy. The EU is moving towards a unified standard across the continent to harmonise requirements for EV charging equipment and compressed gas dispensers, including hydrogen. This will eliminate the need for 27 separate national certification regimes, likely lowering the costs for companies. For consumers, this will ensure transparent billing at charging points, while for manufacturers it provides the scale necessary to drive cost reductions.

ECB’s Annual Report

Finally, the debate on the ECB Annual Report with President Lagarde will provide insight into the bloc’s monetary stability. With inflation approaching the 2% medium-term target, the discussion will centre on the data-dependent trajectory for interest rates in 2026.

Beyond interest rates, the questions regarding the digital euro and the ECB’s role in supporting green investments will feature prominently. The Parliament will ultimately assess whether the Bank’s focus on price stability remains adequately aligned with the broader objective of economic resilience of the Eurozone.

Image source: Munich Security Conference 2025 (Friedrich Merz, Ulf Kristersson, Mette Frederiksen and Petr Pavel)