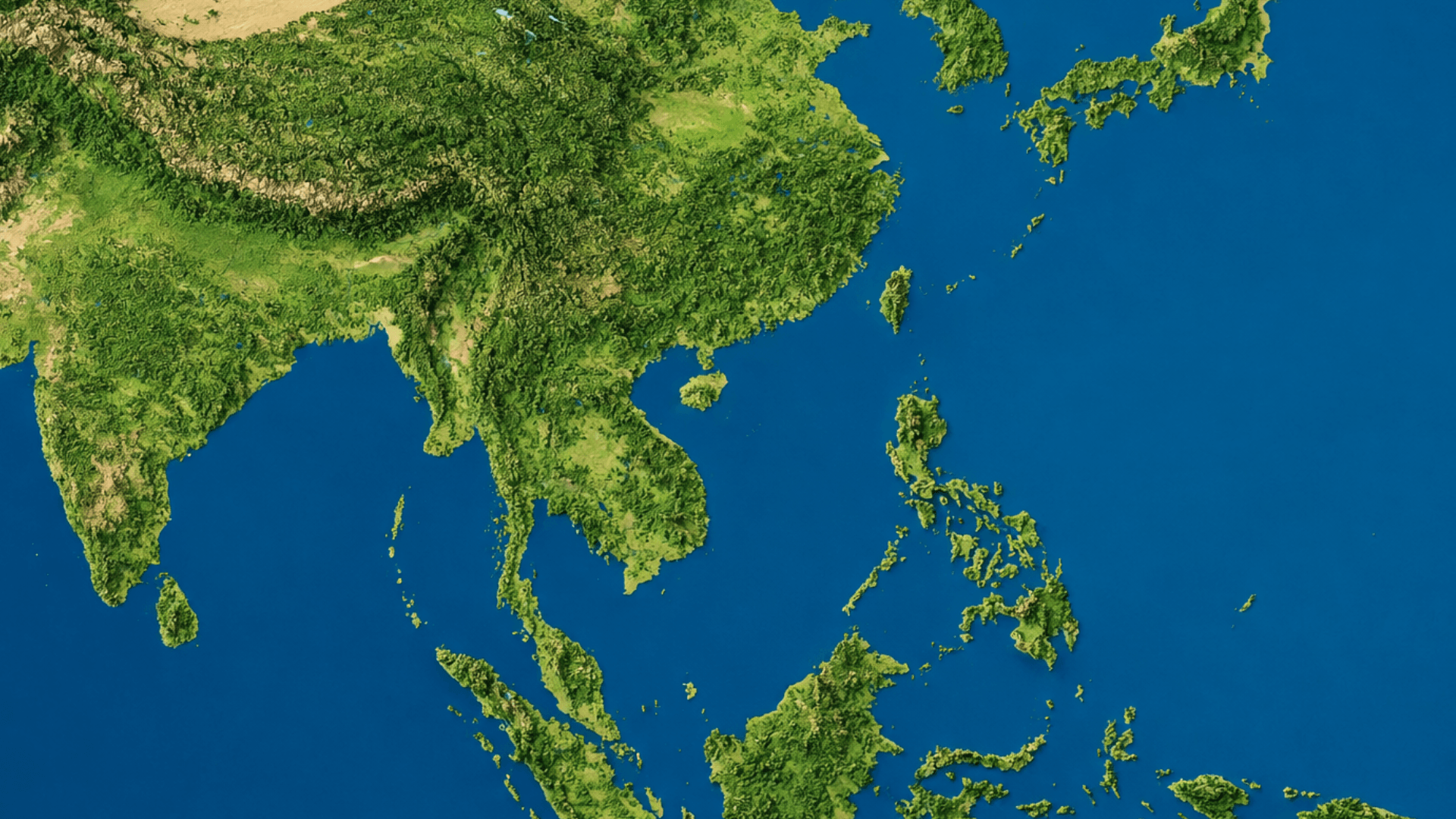

The Taiwan “Limited Blockade” Scenario & The 2026 War Scenario

The 2026 War Scenario: Strategic Context

The US Naval War College’s Phase III scenario, published in 2023, outlines a plausible if dangerous pathway to conflict in 2026. The scenario posits that following the January 2024 Taiwan presidential election, politics in Taiwan trend further toward independence.

Simultaneously, China’s economy slows due to global reshoring trends, and youth unemployment remains at or near 20%. President Xi Jinping, facing domestic pressures, increasingly stokes nationalist sentiments and paints China as the victim of international aggression.

The Mechanics of a Conflict:

According to the imagined Phase III scenario, a collision between a People’s Liberation Army Navy (PLAN) ship and a U.S. Navy destroyer in the Taiwan Strait in late 2025 would provide the spark for conflict. In 2026, China would then declare an operation to “restore the integrity of Greater China,” and the PLA rapidly takes control of Taiwan’s offshore islands, the Penghus, and the southern third of Taiwan, including the port of Kaohsiung.

The PLA would then conduct swift ballistic and cruise missile attacks, neutralising the U.S. 5th Air Force in Japan, destroying most U.S. Air Force aircraft on the ground at Kadena and Misawa. U.S. naval facilities in Yokosuka and Sasebo are heavily damaged, with the command ship USS Blue Ridge and carrier USS George Washington sunk or heavily damaged. Seventh Fleet commander is killed. The global economy, equity markets, and capital flows take major hits

Concurrent ballistic and cruise missile attacks would then neutralise the U.S. 5th Air Force in Japan, and area denial platforms would sink or heavily damage US aircraft carrier fleets. China would then encourage Russia and Iran to take advantage of the Pacific war to stir up tensions in the Black Sea, Eastern Europe, the Strait of Hormuz, and broader Middle East, effectively dividing US military attention.

While the Phase III scenario has not, yet, come to pass, it is illustrative in the U.S. defence establishment’s posture concerning a potential future flare-up.

The Mechanics of a Limited Blockade:

Beijing would likely frame a limited blockade not as an act of war but as a customs enforcement action, restricting specific maritime vessels or aircraft from entering Taiwanese ports to block “contraband” (weapons).

Impact on the EU

- Supply Chain Cardiac Arrest: Taiwan produces over 90% of the world’s most advanced semiconductors. Even a partial blockade would disrupt supply chains for EU manufacturers. Estimates suggest the EU could lose 1% of GDP solely from disrupted semiconductor flows.

- Diplomatic Tightrope: The EU would be pressured by Washington to impose sanctions on Chinese financial institutions. However, given the EU’s economic dependence on China, achieving unanimity for maximalist sanctions would be difficult. Specifically, nations with deep industrial ties to Beijing namely Germany, Hungary, and Slovakia would likely resist broad sanctions that could trigger reciprocal economic devastation.

- Military Escalation Risk: If a blockade escalates into kinetic conflict, Europe faces a choice between supporting the US-led response or maintaining strategic autonomy. The outcome will depend on the nature of Chinese escalation and the speed of US decision-making.

Impact on Europe

A Taiwan crisis in 2026 would represent one of the most acute challenges to European strategic coherence since the Cold War. The event would force the EU to recalibrate its approach to China while simultaneously demonstrating the persistence of US primacy in the Indo-Pacific.

For European firms dependent on Taiwanese semiconductors and Chinese markets, a conflict would trigger severe supply-chain disruptions and necessitate rapid industrial recalibration.

South China Sea Militarisation

Beyond Taiwan, 2026 will see the further militarisation of the South China Sea. China may operationalise a permanent logistics hub in the Solomon Islands or expand its footprint in the Paracel/Spratly chains.

China’s Assertive Posture:

China may be tempted to transition geopolitically from defence to a more forward-leaning offensive approach in 2026.

EU Response:

- Naval Presence: The EU, via its “Pacific Step-up” strategy, will likely increase maritime security cooperation. Member states with naval projection capability (France, Germany, Netherlands, Italy) will deploy assets for freedom-of-navigation operations, risking “grey zone” incidents with the People’s Liberation Army Navy (PLAN).

- Freedom of Navigation Operations: These operations, while symbolically important, carry escalation risks if Chinese forces perceive them as provocative.

Impact on Europe

EU naval deployments to the South China Sea will signal solidarity with regional partners like the Philippines and Vietnam but may also invite Chinese diplomatic complaints and counter-escalation. The region’s militarisation underscores the need for European naval modernisation and expanded presence in the Indo-Pacific.

Read the full B&K Agency Global Outlook for 2026: